Financial markets create a huge amount of data every day.

Banks handle millions of payments, investment companies watch many market signals, and insurance companies look at thousands of risk details.

But even with all this data, most companies don’t use it very well.

This is where predictive analytics helps.

Predictive analytics uses smart computer programs and machine learning to turn data into useful information. With this, financial companies can:

-

Make better decisions

-

Reduce risks

-

Earn more money

-

Keep customers happier

This article explains how predictive analytics gives finance companies a big advantage over others. It also shows real examples of big companies using both internal and external data in smart ways.

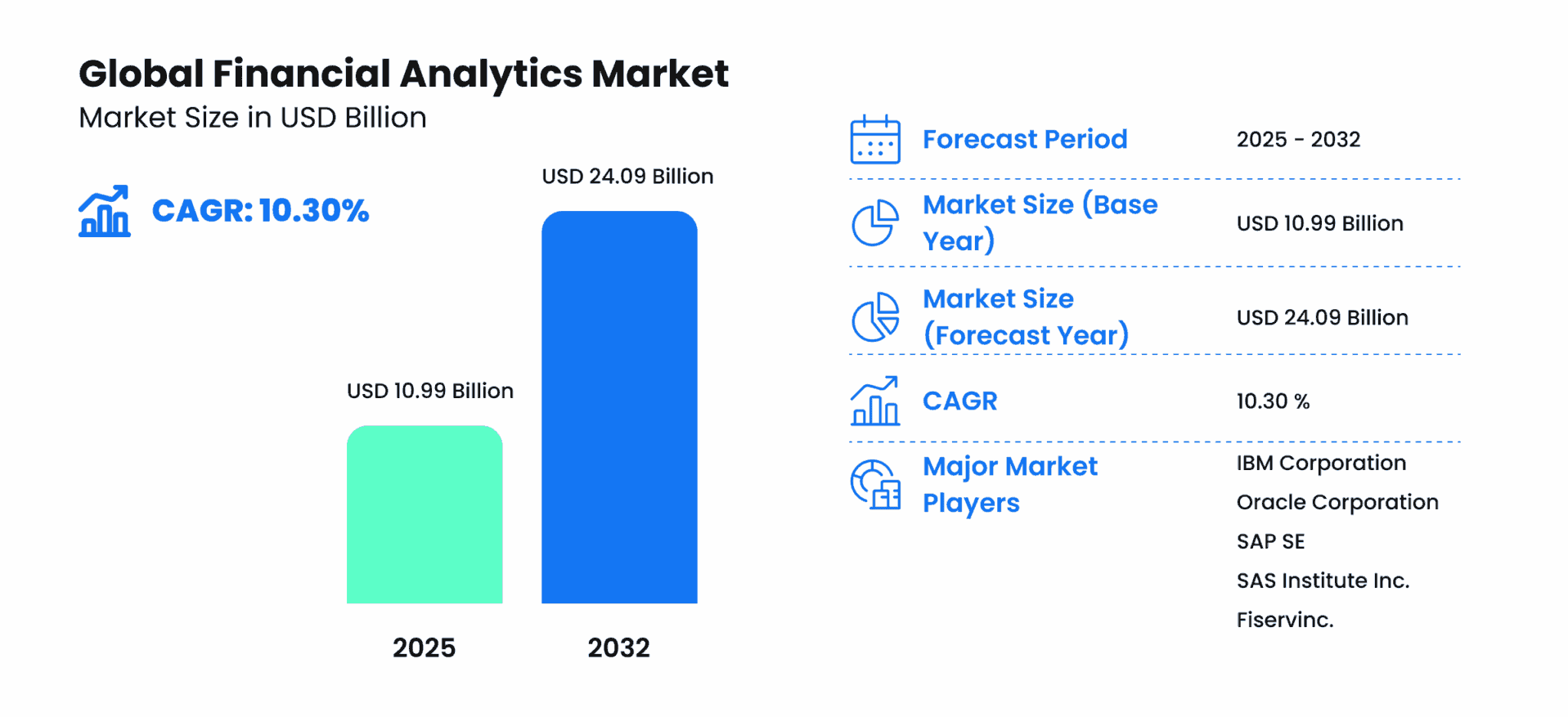

Financial Analytics Market Trends

The market for financial data analytics is growing fast.

According to research:

-

The global market was worth $10.99 billion

-

It is expected to grow to $24.09 billion by 2032

This growth is happening because companies now understand that making decisions based on data is very powerful and helps them stay competitive.

There are some big changes happening in financial technology (fintech) software:

-

Cloud-based tools are making smart analytics available to even medium-sized companies.

-

Companies can now process data instantly, which helps them make faster decisions.

-

AI and machine learning are being used to do complicated analysis automatically, instead of needing lots of people to do it.

-

Rules and regulations are pushing banks to use these tools more. Banks now need to show proof of risk management and fraud prevention. Predictive analytics helps them do that quickly and accurately.

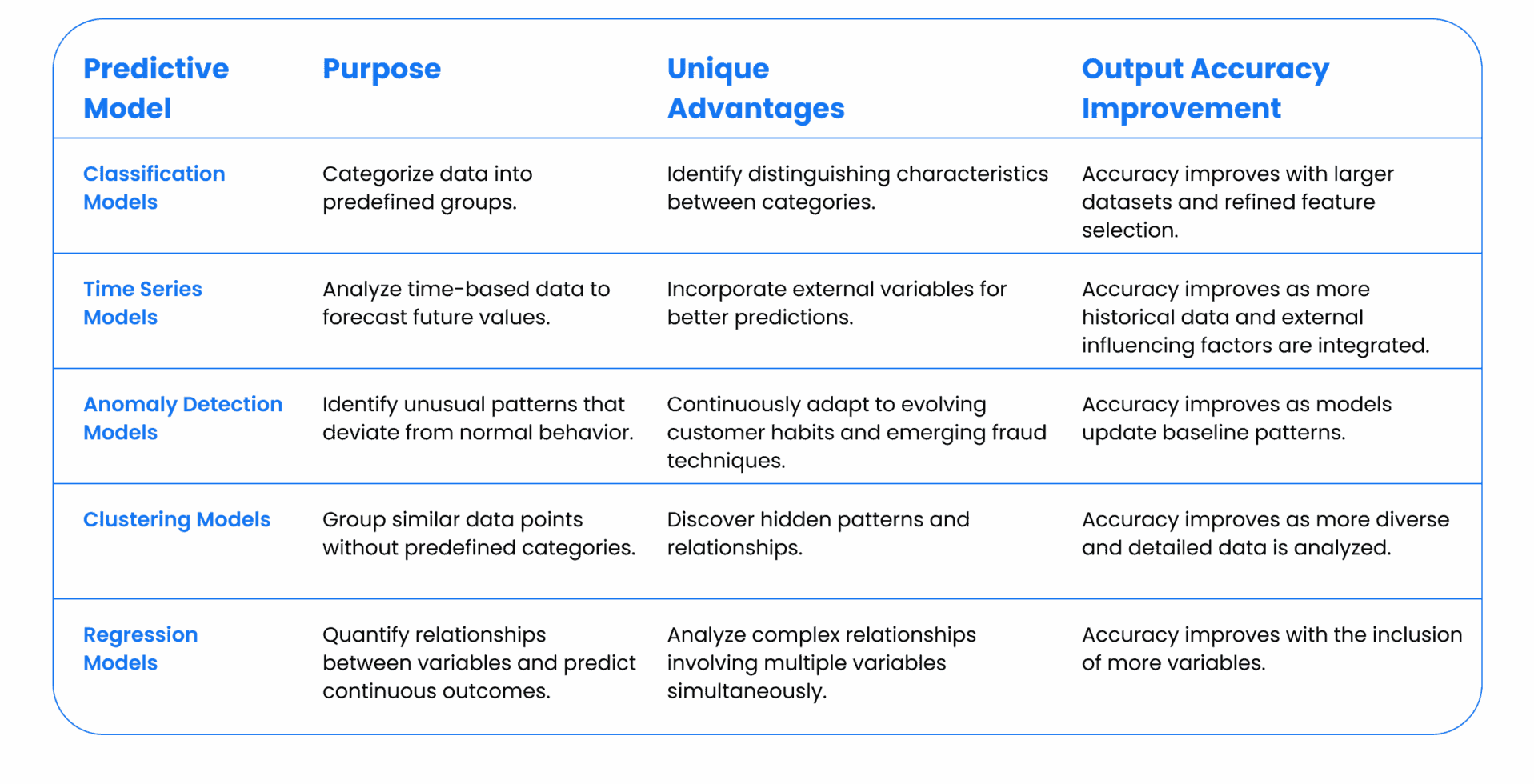

Top 5 Predictive Analytics Models in Finance

To use predictive analytics properly, you need to know the main types of models. These models help companies understand data and make smart predictions in finance.

Predictive Analytics in Finance: Models, Benefits, and Use Cases

Financial markets generate massive amounts of data every day. Banks process millions of transactions, investment firms track countless market indicators, and insurance companies analyze thousands of risk factors. Yet, many organizations barely tap into this potential.

Predictive analytics changes that. By using advanced algorithms and machine learning (ML), financial institutions can extract actionable insights, improve profitability, manage risk, and enhance customer satisfaction.

Financial Analytics Market Trends

The financial analytics market is growing rapidly. According to Data Bridge Market Research, global valuations were $10.99 billion, expected to reach $24.09 billion by 2032. Growth is driven by the recognition of data-driven decision-making as a strategic advantage.

Key fintech trends shaping predictive analytics include:

-

Cloud-based analytics platforms make sophisticated tools accessible to midsize organizations.

-

Real-time processing enables faster market response.

-

AI/ML integration automates complex analyses, reducing manpower needs.

-

Regulatory compliance drives adoption, as predictive analytics provides detailed documentation and operational efficiency.

Top 5 Predictive Analytics Models in Finance

Understanding which model fits your data is crucial. Here are the main types:

-

Classification Models

-

Group data into categories (e.g., loan approval: low-risk vs. high-risk, detecting fraudulent transactions, segmenting customers).

-

Use historical trends and features such as income, debt-to-income ratio, and credit score.

-

Accuracy improves with larger datasets and refined features; can exceed 90% accuracy.

-

-

Time Series Models

-

Forecast future events based on historical data.

-

Useful for stock prices, interest rates, and economic indicators.

-

Advanced ML models can include external factors like commodity prices and economic reports.

-

-

Anomaly Detection Models

-

Identify unusual transactions or behaviors that deviate from normal patterns.

-

Constantly update as customer behavior changes or new fraud strategies appear.

-

-

Clustering Models

-

Group similar data points without predefined labels.

-

Example: Customer segmentation for marketing, personalized services, or risk assessment.

-

-

Regression Models

-

Examine relationships between variables.

-

Examples: Predicting loan demand based on interest rates or portfolio performance based on market volatility.

-

Can handle multiple interrelated factors for more accurate predictions.

-

Why Use Predictive Analytics in Finance?

Predictive analytics addresses several challenges in modern finance:

-

Dynamic markets require proactive decision-making.

-

Customers expect highly personalized services.

-

Regulatory requirements are constantly expanding.

-

Fraud prevention remains a critical issue.

By using real-time data, predictive analytics allows institutions to anticipate risks and prevent problems, rather than just reacting to them.

Key Use Cases

-

Stock Trading & Portfolio Management

-

Analyze large volumes of market data quickly.

-

Optimize portfolios with risk-return diversification.

-

Rebalance positions automatically according to market trends.

-

-

Budgeting & Accounting

-

Predict revenue, expenses, and cash flow accurately.

-

Automated variance analysis identifies gaps for faster action.

-

-

Marketing & Sales Personalization

-

Predict customer behavior for targeted campaigns.

-

Customer lifetime value models guide long-term investment decisions.

-

-

Credit Scoring

-

Consider non-traditional factors like social media activity or online behavior.

-

Helps assess creditworthiness for individuals with limited credit history.

-

-

Fraud Detection & Prevention

-

Real-time systems detect suspicious transactions.

-

ML adapts to evolving fraud tactics.

-

Behavioral analytics create individual profiles for enhanced security.

-

Real-World Examples

-

JPMorgan Chase: Uses predictive models for loan approvals with 85% accuracy, reducing risk exposure.

-

Carbon Bank (Africa): Uses DataRobot AI to evaluate credit risk, improving lending decisions and lowering defaults.

-

PayPal: Analyzes transaction and device behavior to detect fraud in over 20 billion yearly transactions.

-

Bank of America: Uses predictive models to optimize product offerings and customer retention.

-

Morgan Stanley: Employs predictive analytics to forecast market volatility and optimize portfolios.

Top Predictive Analytics Platforms for Finance

-

SAS Advanced Analytics: Comprehensive system for risk management, fraud detection, and regulatory compliance.

-

IBM SPSS Statistics: User-friendly interface with powerful algorithms for non-coders.

-

Tableau + R/Python: Interactive dashboards and visualizations for complex models.

-

Microsoft Azure Machine Learning: Cloud-based predictive analytics service.

-

Palantir Foundry: Big data analysis and integration, ideal for large firms with multi-source datasets.

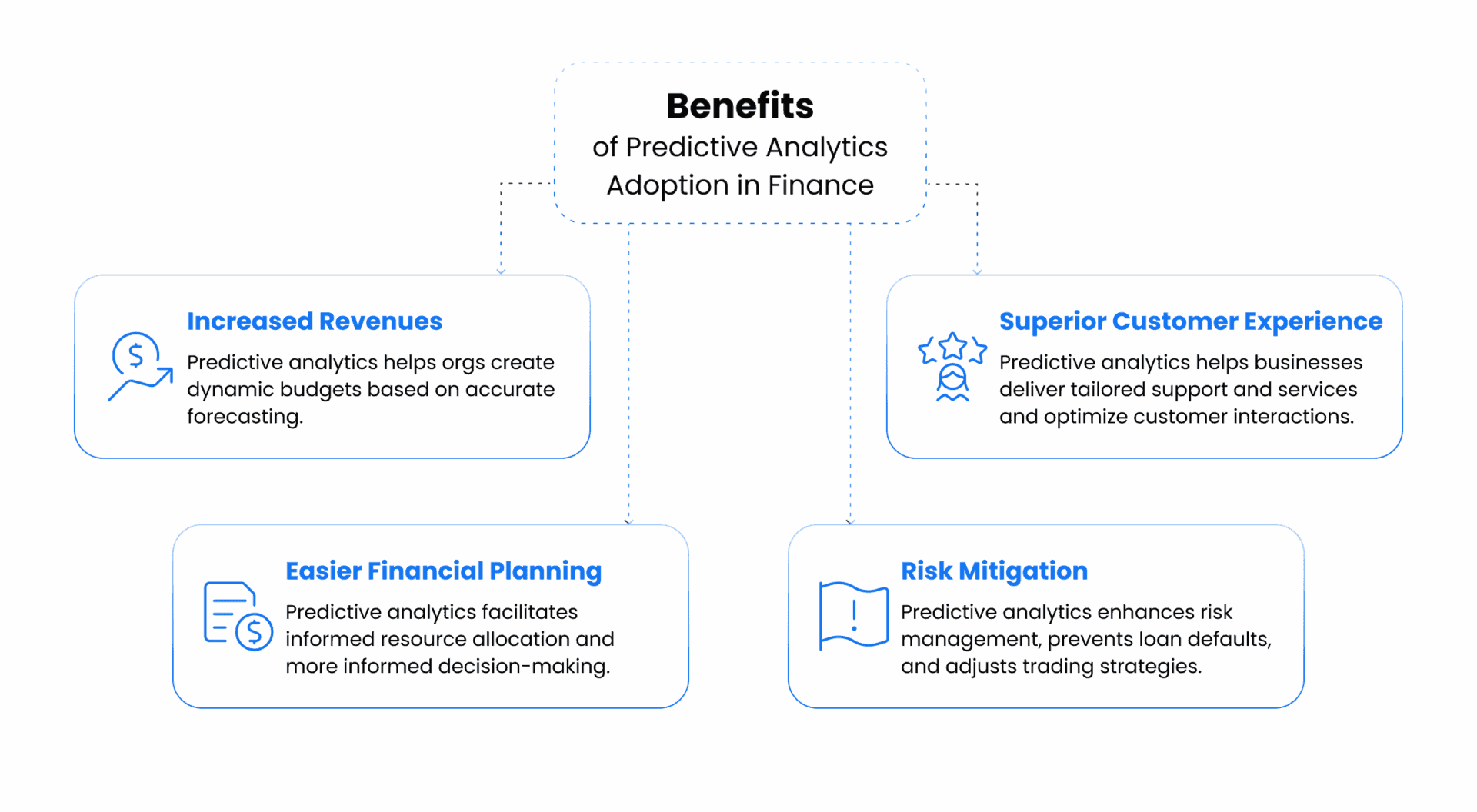

Unlocking the Benefits of Predictive Analytics in Finance

If your organization decides to implement predictive analytics solutions across financial processes, you can anticipate several tangible advantages:

1. Increased Revenues

Predictive analytics drives revenue growth by enabling accurate forecasting. Organizations can anticipate market fluctuations, create dynamic budgets, and plan future investments more effectively.

-

Loan defaults can be predicted using models that analyze payment history, income, and other relevant factors, reducing financial losses.

-

Investment strategies benefit from precise projections, improving overall profitability.

2. Easier Financial Planning

While historical trends form the backbone of traditional financial planning, predictive analytics considers a broader scope of factors, producing more precise forecasts.

-

Enables optimal resource allocation.

-

Improves decision-making with data-backed insights.

-

Enhances stakeholder confidence in financial forecasts.

3. Risk Mitigation

Risk management is one of the most critical applications of predictive analytics in finance. Although no model can foresee “black swan” events, predictive tools are significantly more effective than traditional methods:

-

Credit risk analytics: Identify high-risk applicants early, preventing defaults.

-

Market risk analytics: Allow traders to adjust positions before unfavorable movements.

-

Operational risk models: Detect internal gaps that could lead to non-compliance or financial losses.

Impact: Financial institutions using predictive risk models report 20–40% fewer unexpected losses compared to peers relying on traditional approaches.

4. Superior Customer Experience

Predictive analytics enables hyper-personalization, improving how financial institutions interact with clients:

-

Personalized product recommendations based on customer behavior and preferences.

-

Optimized customer service interactions with proactive issue resolution.

-

Model-driven predictions help support teams anticipate client needs before they arise, enhancing satisfaction and loyalty.

Final Word

Predictive analytics is a powerful tool, but success depends on strategic implementation:

-

Begin with tactical use cases that address immediate business challenges.

-

Expand analytics capabilities gradually, aligned with long-term goals.

-

Collaborate with experienced analytics providers who understand financial regulations and industry-specific requirements.

With the right expertise and approach, predictive analytics can unlock measurable business value and transform financial decision-making.

Contact Us

Want to unlock the power of your financial data? AST Services helps companies across industries design and implement predictive analytics systems tailored to business needs and growth objectives.